Three brilliant AI startups that revolutionize Fintech

Machine Learning tools for predictive analysis, robot for asset management, trading algorithm, and blockchain technology. AI pal that learns to budget your expense.

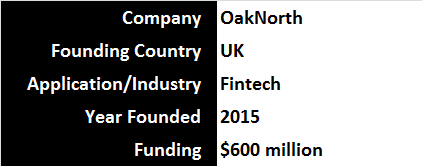

ACORN OakNorth

The Biggest AI Startup in UK

OakNorth is Europe’s fastest-growing fintech by assets and valuation with a mission to enable entrepreneurs worldwide to access customized mid-sized loans. OakNorth is developing an online-only Small and Medium Enterprise (SME) lending platform using a proprietary loan origination and scoring algorithm called ACORN machine. The company joined the unicorn club of the UK with the latest $125 million investment of Singaporean sovereign wealth fund GIC by the end of 2017. OakNorth has two major revenue streams: originating loans for SMEs, and selling the ACORN technology to other institutions.

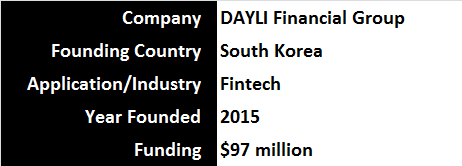

DAYLI

Four Disruptive Technologies in One

DAYLI Financial Group has raised $97 million to create a broad AI fintech platform that includes tools for predictive analysis and modeling, a robo asset management advisor, a trading algorithm, and blockchain technology. The applications are built as separate modules and are available to financial institutions separately so clients can build their own systems as if using Lego blocks. Use cases show significant business value-add, for example a 10% increase in loan approval rates, or credit card user growth of 20% post implementation. The company acts as a one-stop-shop for everything related to fintech and is present in Asia Pacific, Europe, and North America.

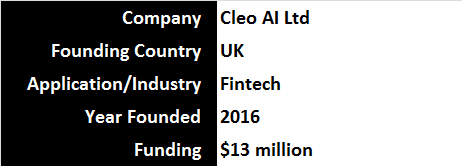

Cleo

Your AI pal that looks after your money

Budget, save and track your spending. Cleo raises $10M Series A to help millennials better manage their money. Meet Cleo is an AI service that helps you manage your money. The AI is used through Facebook Messenger, text message, Amazon Alexa and Google Assistant, where you can ask it questions relevant to your account and spending habits, and receive instant feedback and advice. It’s emoji/gif friendly and uses humor and a friendly tone which is very welcome in terms of bank/money management!