Boost Debt Collection and Recovery using Machine Learning [part 1/5]

Predictive Analytics can be used to increase Collections and Recoveries. Case study done in this article describes a machine learning model developed in R to enhance debt collection process for lending companies in financial sector.

![Boost Debt Collection and Recovery using Machine Learning [part 1/5]](/content/images/size/w1200/2024/05/debt_recovery_using_machine_learning.webp)

Predictive Analytics is not only used to reduce loan defaults but it can also be used to increase debt collections and recoveries. This article describes a case study that is based on predictive modeling and machine learning which helped credit lending companies in improving debt recovery rate. The goal of the case study was to boost debt recovery by enhancing the traditional debt collection system of the crediting company. The predictive model implemented in this case study enhances an existing recovery system by creating focus groups for business to boost debt collection.

Disclaimer: This case study is solely an educational exercise and information contained in this case study is to be used only as a case study example for teaching purposes. This hypothetical case study is provided for illustrative purposes only and do not represent an actual client or an actual client’s experience. All of the data, contents and information presented here have been altered and edited to protect the confidentiality and privacy of the company.

Given the economic situation and with the increasing competition in the lending business and services sector, collection functions of all the companies across the financial business spectrum are feeling pressure. The traditional characteristics of debtors across the industries are no longer appropriate. The tools and techniques previously used are far out of date.

The economic changes in recent years have had a key impact on the debt collection functions of the Businesses. it is much more difficult now to differentiate between customers who have simply fallen behind in their payments and customers who plan on staying behind. Furthermore, businesses are increasingly interested in how big data, artificial intelligence and machine learning can be used to increase revenue, lower costs, and improve their business processes. It is time for the collection teams to embrace the future and adopt new models not only to cut cost but also to become agile in adapting the changes.

We reassessed the traditional recovery system and came up with an AI based enhancement to the traditional system that can significantly improve the performance of recoveries.

1. Understanding Recovery System

Those who are familiar with the finance lending business or credit business understands that as long as customer pays the due balance it remains normal to the crediting company. Upon failure of making the payment, customer's account becomes default. At this point delinquency begins which leads to collection and recovery. Given below describes different phases (in sequence) of customers in delinquency and recovery.

- Delinquency: An account goes to Delinquency when a payment of minimum due is not made by customer upon reaching overdue date.

- Collection: An account goes to Collection when a payment is not made by customer for three statement in a row.

- Recovery: An account is marked for Recovery when it reaches six months of non payment.

If we look at the traditional debit collection process there are three entities/players involved in debt collection process other than customer himself as given below:

- Crediting Company: It is the main crediting company. Once a recovery case is created, it is assigned to one of the collection agents of the crediting company. This assignment is done by Collection Manager based on his experience with the team and performance of collection agent.

- Collection Agency: A collection agency is a third party that is hired by the crediting company to collect the debt on their behalf. Collection agencies usually get paid with a percentage of the money they recover or a flat fee.

- Lawyer: Lawyers might become involved in the recovery process at any time, even before a lawsuit starts. Some collection law firms are basically collection agencies, with large collection departments. The lawyers at these firms might not actually have any direct involvement with your debt. Once a lawsuit to collect the credit card debt against you begins, though, a lawyer will definitely be involved, though perhaps minimally. (Lawyers trying to collect large volumes of credit card debt from different debtors usually spend little time on each individual suit.)

2. Goals and Objectives

For this case study, objectives are to see how crediting companies can benefit from Artificial Intelligence and to see how this new AI based methodology can be used to increase revenue, lower costs, and improve their business processes. Given below are the key objectives of the project.

- Optimum Cost: Labour costs are the single biggest expense that recovery department face. This new AI based enhancement will identify focus groups for a more effective debt collection strategy to help reduce costs, save time and maximize resources.

- Improved Collector Efficiency: This machine learning model will improve agents efficiency by creating focus groups. This will not only increase promise to pay rate but also suggest best suitable agent to the case. This will be done using historical data and agent’s best performing markets and category of cases resolved.

- Prioritization: Recovery prioritization and strategy is a key to increase revenue. The machine learning algorithms in this model will improve collection efforts and increase recovery amount by identifying customers with the highest and quick payment probability. This re-prioritization of customers by the model can be done regularly i.e weekly or monthly.

- Up-to-date information at one place: While working on the case, it is difficult for a collection agent to go back and fourth into various files and systems to view updated information. This will be resolved through standardized reports. Comprehensive dashboards will be available to the agent which will contain all necessary up-to-date information (contact info, balances, additional info etc.) for the agent to start or resume working on a particular case.

- Regular Monitoring: Reporting dashboards will be refreshed daily for regular monitoring of debtor account since model will re-prioritize the account regularly on the basis of chances of payment. Using this dashboard collection manager will devise strategy to work the accounts and collect unpaid balance. It will also provide complete portfolio intelligence and monitoring of the ongoing collection process.

- Dynamic Communication: Based on the past interactions with the customers and demographics, the model will suggest the best mode of communication. For instance, in general Baby Boomers and GenX respond well to calls, while iGen and millennial generally respond better to text reminders.

- Interactive Dashboard for Recoveries: To provide wholistic view of recovery performance. The data produced by the model will be used in-conjunction with customer basic data to build a dashboard showing key KPIs along with comprehensive MIS to monitor the recovery process.

3. Overview of the Solution

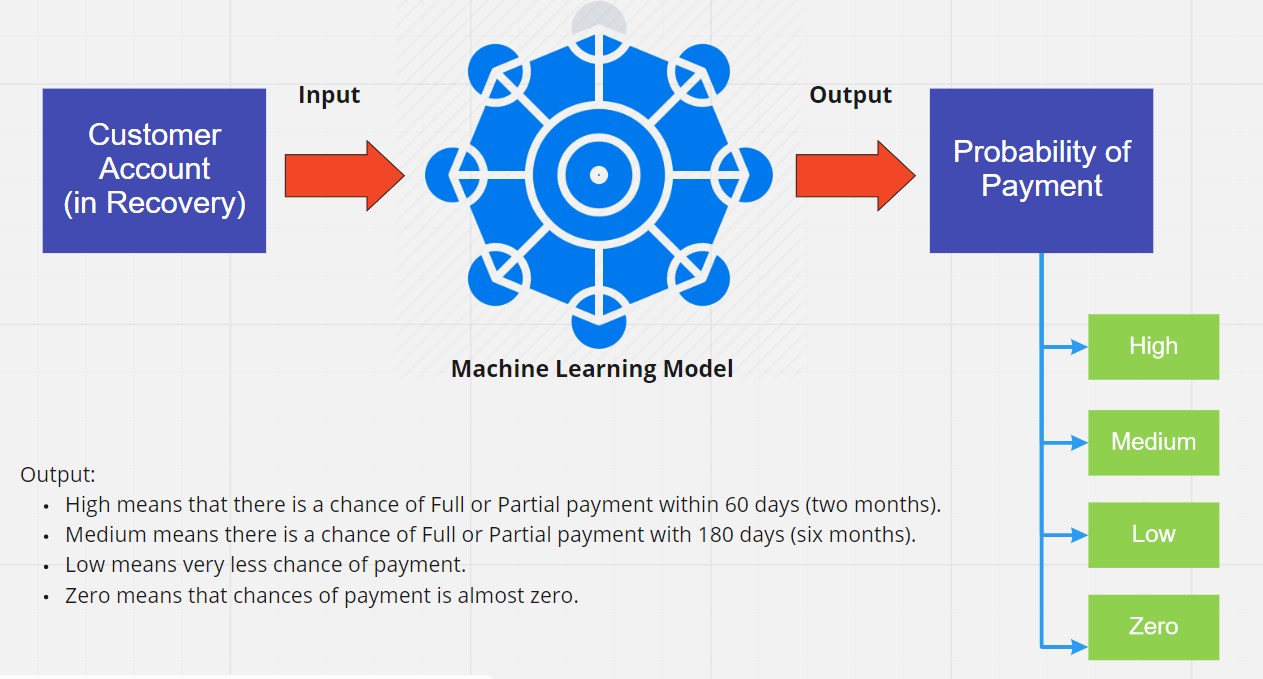

The proposed system can be used as an enhancement to any existing recovery system. We are naming this new enhancement as Machine Learning Boost Recoveries (MLBR). In this enhancement, Machine learning (ML) which is an advanced analytics technique and a sub field of AI will be used. ML teach computers to do what comes naturally to humans by learning from experience. Machine learning algorithms use computational methods to learn information directly from data. These algorithms improve their accuracy with the time as they learn from unseen data.

Predictive Modeling and Machine Learning

Machine learning is an area of computer science which uses cognitive learning methods to program systems without the need of being explicitly programmed. These machines are well known to grow better with experience. Predictive modeling, on the other hand, is a mathematical technique which combine statistics with programming to do prediction. It aims to work upon the provided information and conditions to reach an end conclusion after an event has been triggered. We used machine learning due to the complexity of the problem in hand as well as the number of variables that may get involve. We do not want to restrict predictions based on the knowledge of Subject Matter Expert (SME) or by running statistics on historical data. Instead, we want to discover hidden patterns in the data which can only be possible using machine learning techniques. Furthermore, we wanted to seek advantage of improvement in accuracy as the machine learns from experience and unseen data.

4. High Level design

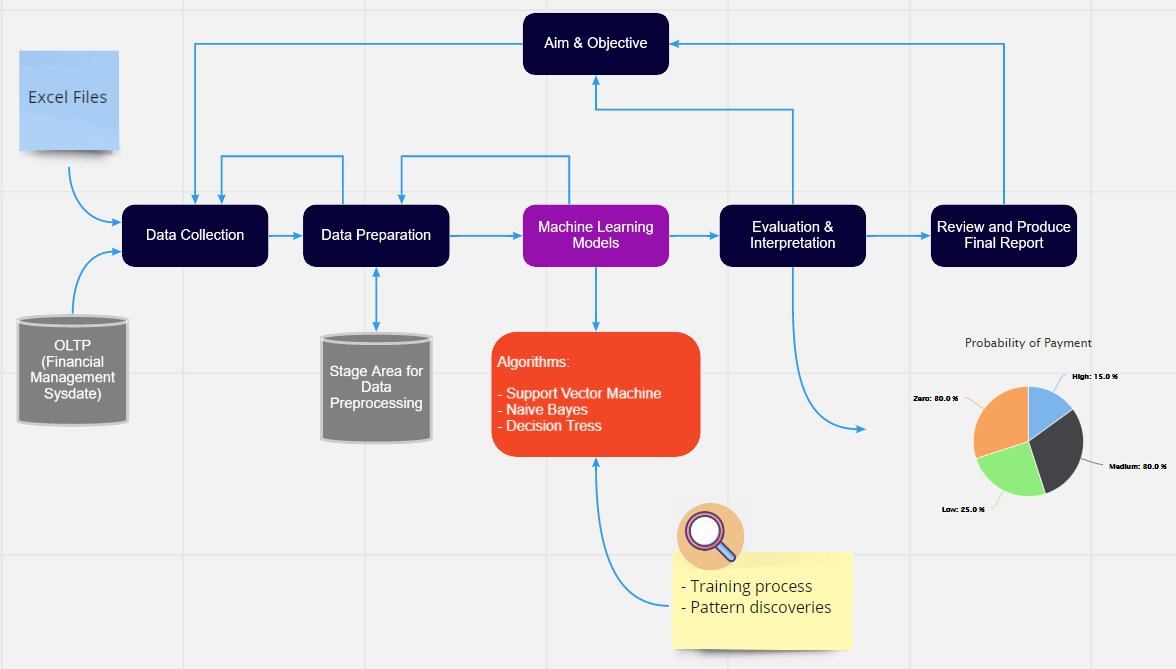

The design of the new enhancement is built by keeping in mind six key areas:

- Data Collection

- Data Preparation

- Modeling

- Testing and Cross Validation

- Production Deployment

- Real world Evaluation

to be continued...

In part-2 we will look at the Data Collection and Preparation.

Cheers :)